mmERCH – Web3 x Fashion Case Study

Free

mmERCH embodies the new generation of NFT projects in 2024, born at the exact intersection between a century-old industry worth close to $100 billion a year, and the cutting-edge opportunities offered by Web3.

Unlike the 1st generation projects (2021 / 2022), mmERCH has decided not to market itself as an NFT Company. It is a brand new Fashion Brand, using NFTs as a technological lever (among others). In this new generation of Web3 projects, the value proposition has completely shifted from the NFT to the physical asset and philosophy conveyed by the brand.

We wanted to take a closer look at how a project of this type would approach the market in 2024, and how it would be received by the market.

- What does it mean to establish a Web3 Fashion brand from scratch?

- What lessons should we learn from this initial drop?

- How did they approach the market?

- What are the keys of their success?

- How did they sell out 960 NFTs at about 5 times the average NFT price?

- How did the secondary market react after the sale?

- Is the market activity 100% legit or manipulated?

- Who are influential sponsors and investors behind the project?

In this report, you’ll find everything you need to know about their sales mechanics, marketing strategy, and all the keys to launch a fashion project in Web3.

FREE

- 100% Free

- State of fashion in 2024

- Digital fashion challenges

- High Quality Infographics

- 30 metrics

- Marketing playbook

- Team, advisors, investors

- Digital copy

SUMMARY

1. Disclaimer

p.03

2. Who are we?

p.04

PROJECT REVIEW

3. Mckinsey’s challenges for Fashion in 2024

p.06

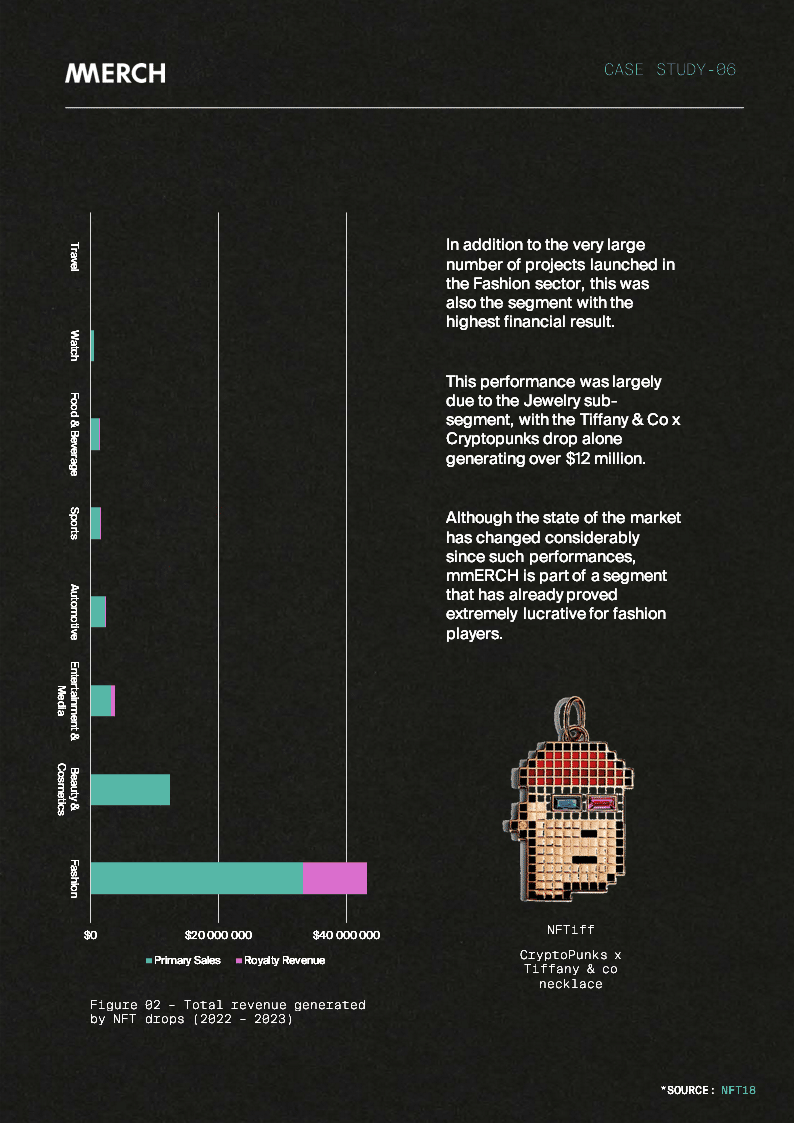

4. Fashion x NFTs projects

p.07

5. What is mmERCH?

p.09

6. The team behind

p.10

7. Advisors & Investors

p.11

8. Key Concepts

p.12

9. Value proposition

p.13

LAUNCH STRATEGY

10. Social Media

p.16

11. Pop-up event

p.17

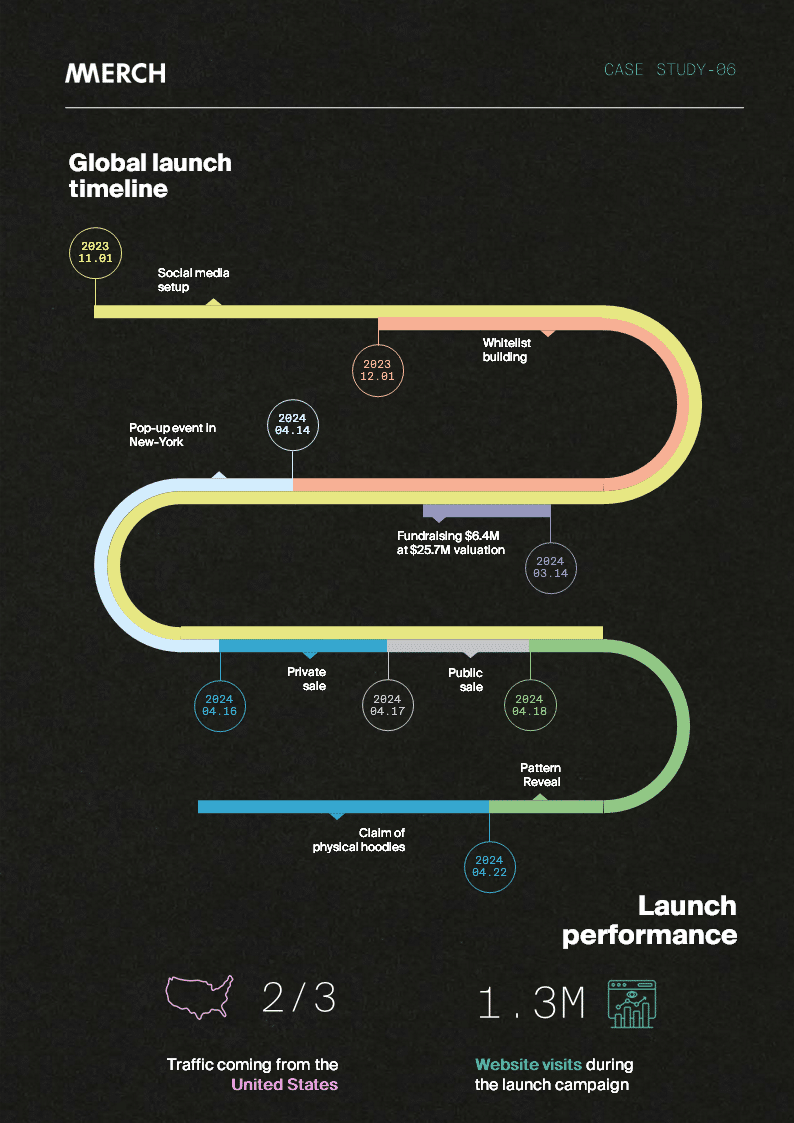

12. Global launch timeline

p.18

13. Drop design

p.19

MARKET PERFORMANCE

14. Primary Market

p.21

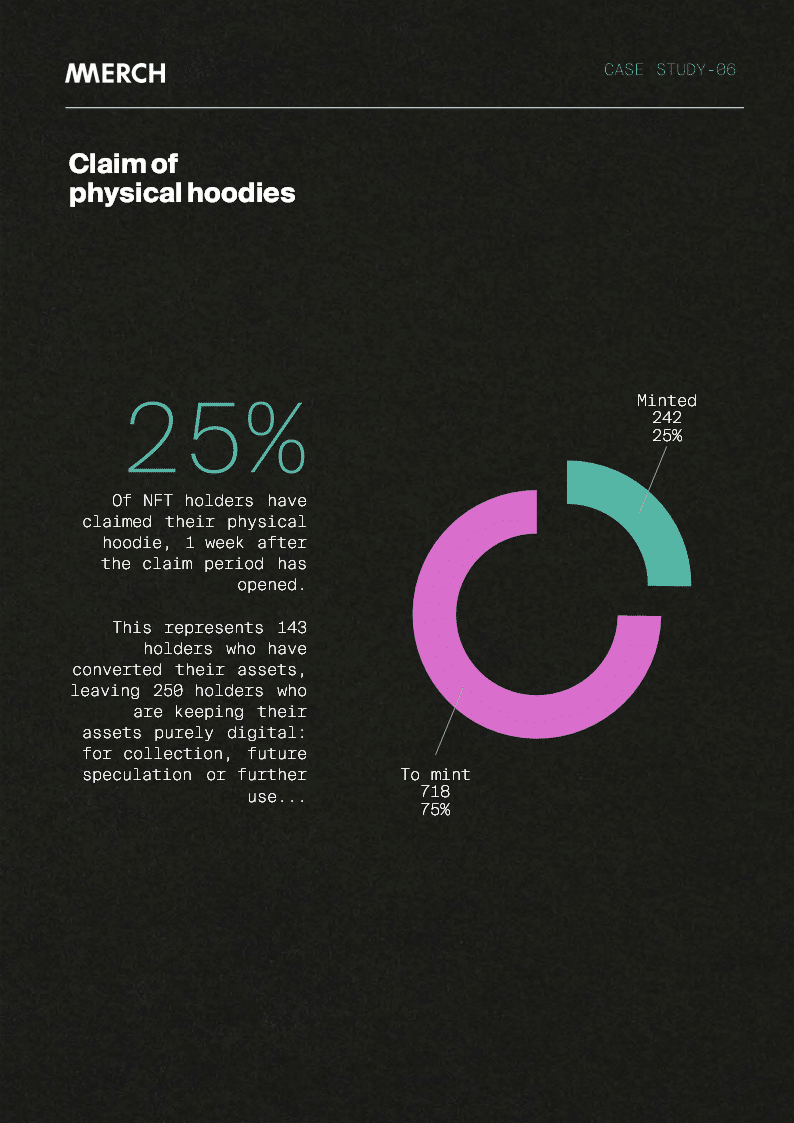

15. Claim of Physical Hoodies

p.22

16. Floor price decrease

p.23

17. Slow secondary market

p.24

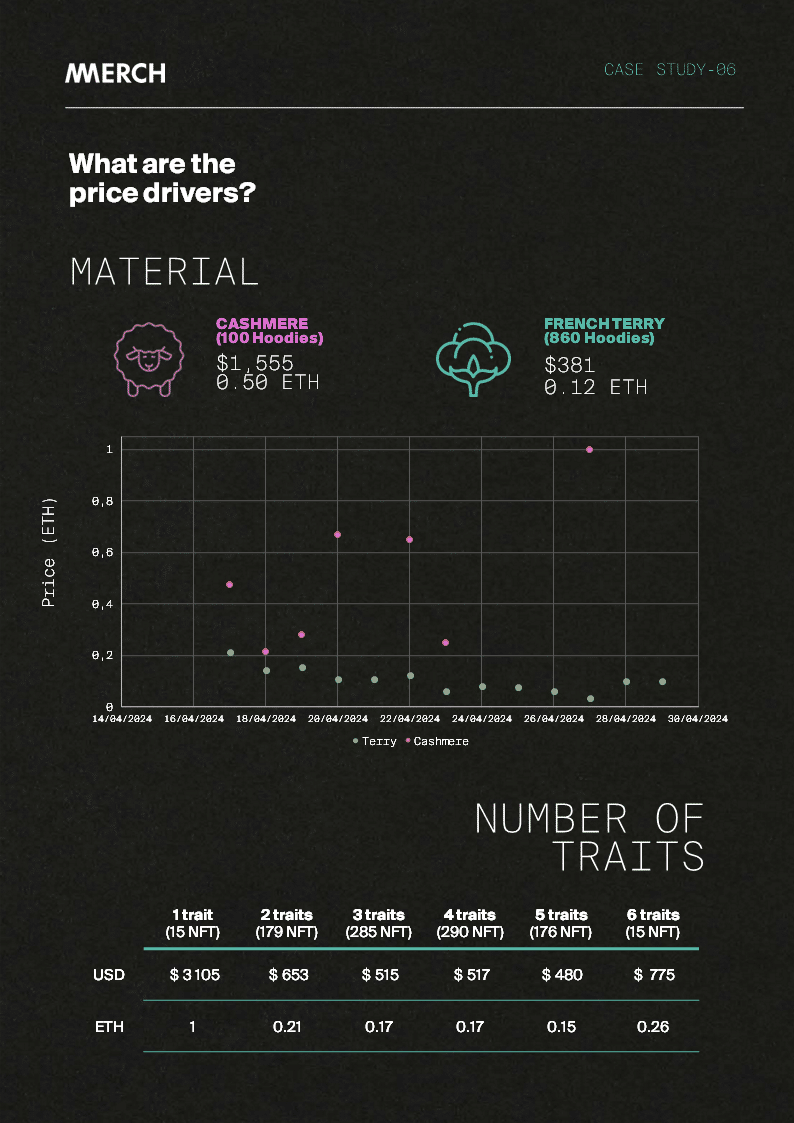

18. What are the price drivers?

p.25

20. Price drivers takeaways

p.27

21. Supply self purchase

p.28

CONCLUSIONS

25. Key Success Factors

p.30

27. Appendix

p.31

Other reports you may like

You may also like…

-

Pro

Free